Automate Your Underwriting Process with Precision

From Operating Statements to Rent Rolls, streamline your underwriting workflows with AutoUW's AI-powered solution.

Why AutoUW?

Powerful features that transform your underwriting process

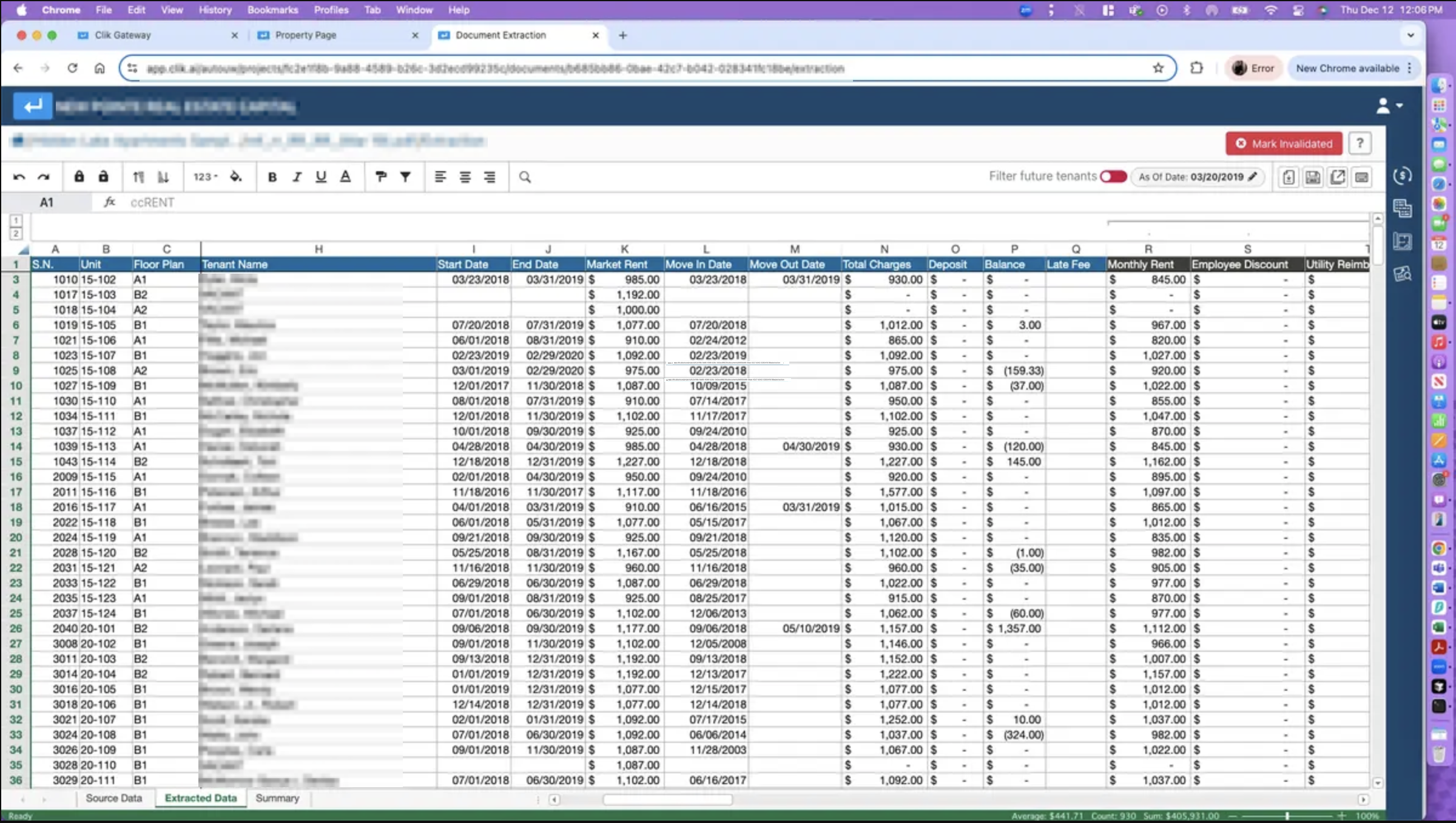

Financial Data Extraction

Extract data from Operating Statements and Rent Rolls with 100% accuracy

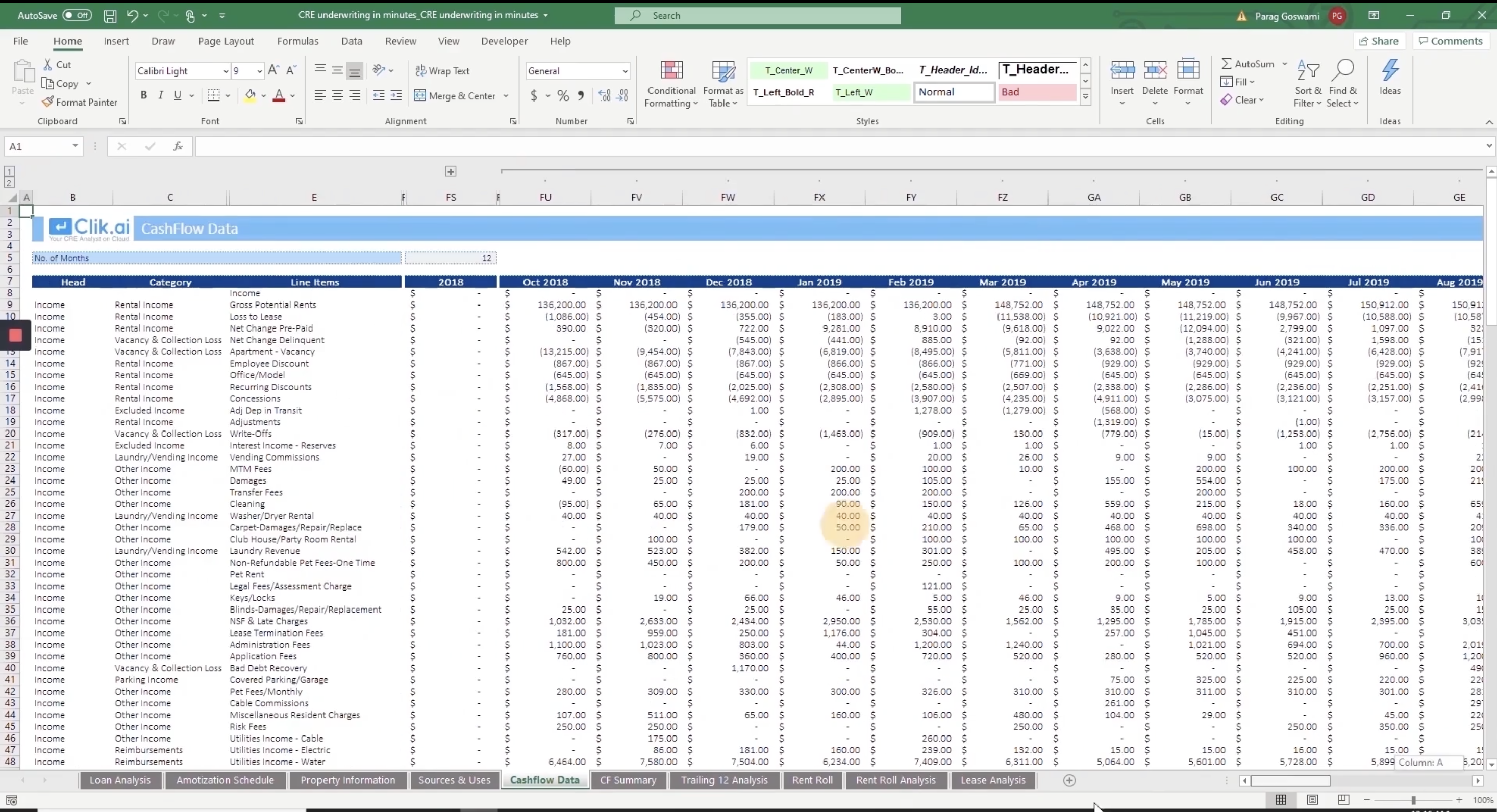

Customizable Outputs

Generate underwriting models tailored to your format or lender-specific templates

Rapid Turnaround

Process deals in minutes, saving 70% of manual effort

AI-Powered Efficiency

Leverage advanced algorithms to automate even complex deals

How AutoUW Works

Simple, efficient, and powerful workflow

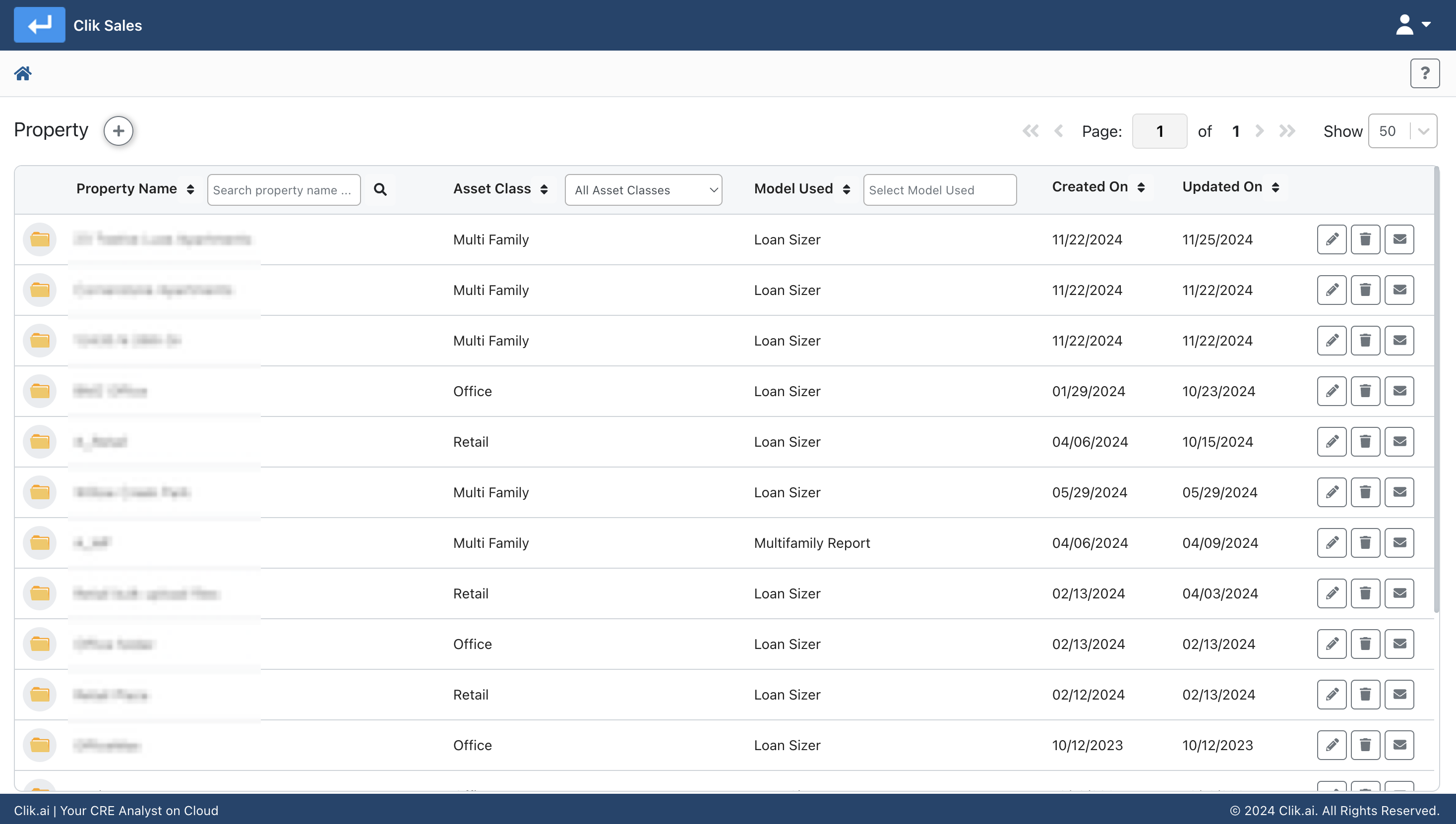

Upload Documents

Easily upload and manage your Operating Statements and Rent Rolls

Data Extraction

AI-powered extraction of critical financial data

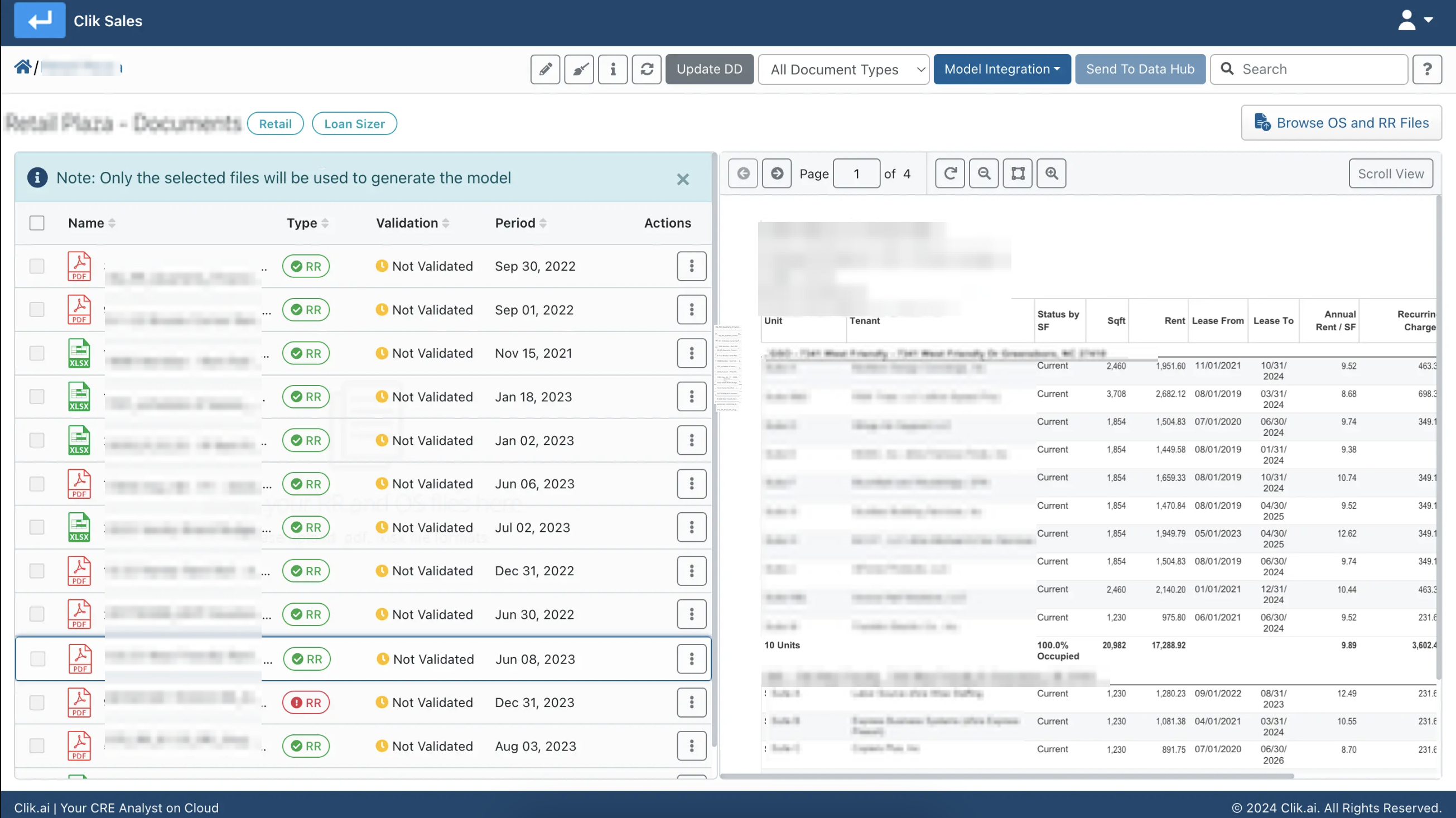

Review & Validate

Verify extracted data with side-by-side document viewing

Download Results

Export comprehensive analysis in your preferred format

Achieve More with AutoUW

Measurable improvements in your underwriting process

Save Time

Reduce underwriting time by up to 70%

Boost Accuracy

Ensure 100% accuracy in data extraction

Scale Effortlessly

Handle up to 50+ deals/month without adding to your team

Frequently Asked Questions

Find answers to common questions about AutoUW

Ready to Transform Your Underwriting?

Schedule a demo today and see AutoUW in action.